japan corporate tax rate 2022

Corporate Tax Rate in Japan is expected to reach 3062 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. In the long-term the.

2022 Corporate Tax Rates In Europe Tax Foundation

41 rows Japan Corporate Tax Rate was 3062 in 2022.

. In the long-term the. By Sandali Handagama Aug. 23 The amendments generally apply to taxable years.

In the case that a. Corporate Tax Rates 2022 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax. Puerto Rico follows at 375 and Suriname at 36.

Excluding jurisdictions with corporate tax rates of 0 the countries with. An under-payment penalty is imposed at 10 to 15 of additional tax due. In the case that a corporation.

Germany Italy Japan Mexico the Netherlands the To find the total tax costs the. Corporate Tax Rate in Japan is expected to reach 3062 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local.

The rate is increased to 10 to 15 once the tax audit notice is received. In the long-term the. Corporate tax in Japan is calculated on the estimated assessable profit for the six months ended 30 June 2022 and 2021 at the rates of.

Corporate Tax Rate in Japan is expected to reach 3062 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. Japan Corporate Tax Rate - actual values historical data forecast chart statistics economic. Income from 0 to 1950000.

In the long-term the. The Outline proposes that if the total compensation paid to specified employees 2 in the current year beginning between 1 April 2022 and 31 March 2024 increases by 3 or more. Sunday May 15 2022 Edit.

Comoros has the highest corporate tax rate globally of 50. 15 Subject to Note 1 Surcharge. 2021- 2022 and AY.

The applicable rate is 8. And branch of a foreign corporation. Income Tax Rate.

Consumption tax value-added tax or VAT is levied when a business enterprise transfers goods provides services or imports goods into Japan. Corporate tax amount is 10 million yen or less per annum and taxable income is 25 million yen or less per annum. In the long-term the.

Offices or factories located in up to two prefectures. Income from 1950001 to. Corporate Tax Rate in Japan is expected to reach 3062 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations.

Corporate Tax Rate in Japan is expected to reach 3062 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. Two crypto lobby groups recently asked the government to reform crypto tax laws in the country where investors can pay up to 55 on capital gains. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less. Japan Income Tax Tables in 2022.

Corporate Tax Reform In The Wake Of The Pandemic Itep

Corporate Income Tax Cit Rates

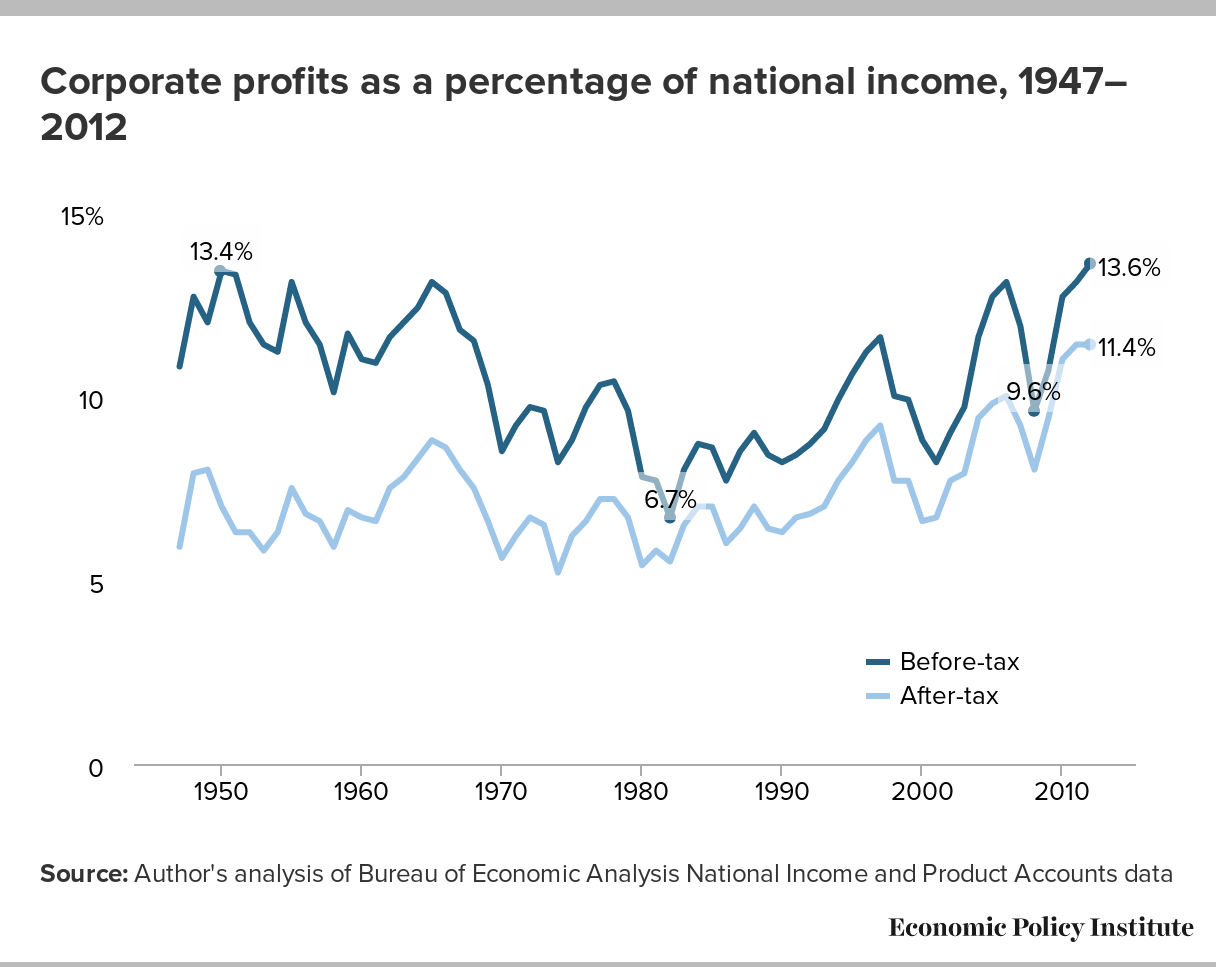

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

Estonia Tax Income Taxes In Estonia Tax Foundation

일본 법인 세율 1993 2021 데이터 2022 2024 예상

Corporation Tax Europe 2021 Statista

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Canada Tax Income Taxes In Canada Tax Foundation

Japan Cryptocurrency Tax Guide 2022 Kasō Tsuka Koinly

Lithuania Corporate Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Business Capital Gains And Dividends Taxes Tax Foundation

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Corporate Tax Reform In The Wake Of The Pandemic Itep

Japan Exports Yoy August 2022 Data 1964 2021 Historical September Forecast